[ad_1]

Key highlights

- UC grew 45% YoY in FY23 while reducing losses

- India’s business broke even in Q1 FY24

Customer obsession. Partner empowerment.

These two values have been central to Urban Company’s build journey. These values define our true north and form the bedrock of our day-to-day operations. In this Annual Business Summary for FY23, we highlight how these values have helped us improve service experiences, enable partners to lead decent middle-income livelihoods and grow meaningfully while progressing toward profitability. We also delve into the efforts to strengthen our corporate governance and ESG practices.

Summary

-

- Revenue from operations grew 45% YoY: From INR 438 Cr. in FY22 to INR 637 Cr. in FY23

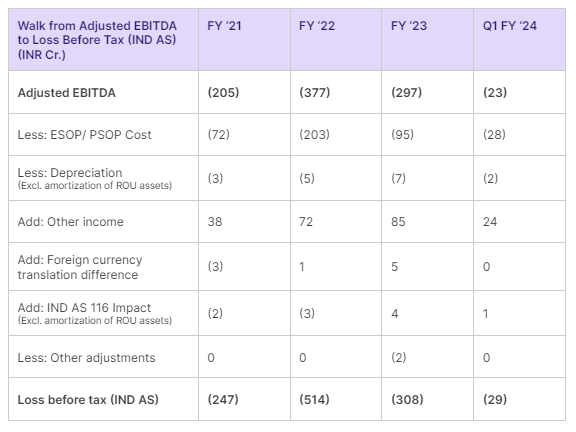

- Losses before taxation (Ind AS) reduced from INR (514 Cr.) to INR (308 Cr.)

- Adjusted EBITDA loss reduced from INR (377 Cr.) to INR (297 Cr.)

- India business broke even at Adjusted EBITDA level for the quarter ended Q1 FY24

- Customer satisfaction: Average ratings on the platform were 4.82/5.0 in FY23, with 77% of the business coming from repeat customers (Acquired in years prior to FY23)

- Corporate Governance: We added three independent board members to the UC Board: Dr Ashish Gupta, Ms Ireena Vittal and Mr Shyamal Mukherjee

- Partner Earnings Index for H1 CY23:

- The top 20% of partners earned an average of ~ INR 40,000 per month, net of all commissions and other related costs (Travel, product expenses etc.) in H1 CY23

- The average net earnings of partners delivering >30 services per month were ~ INR 32,000

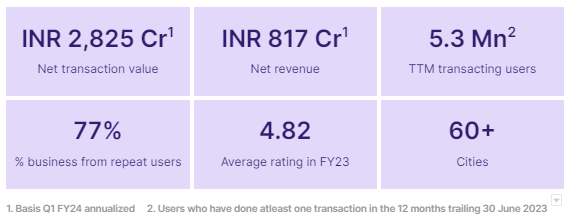

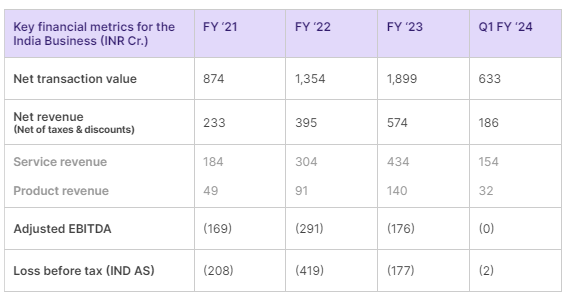

Key operating and financial metrics

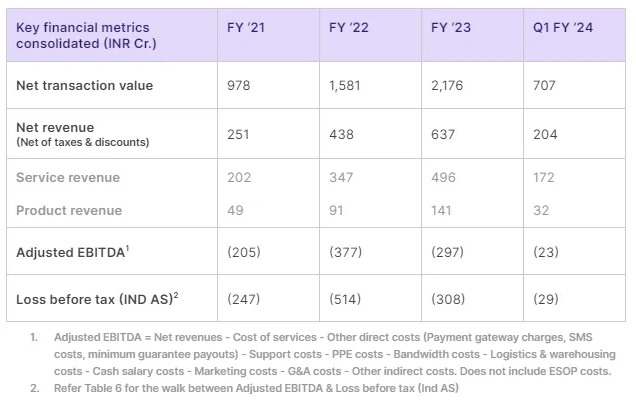

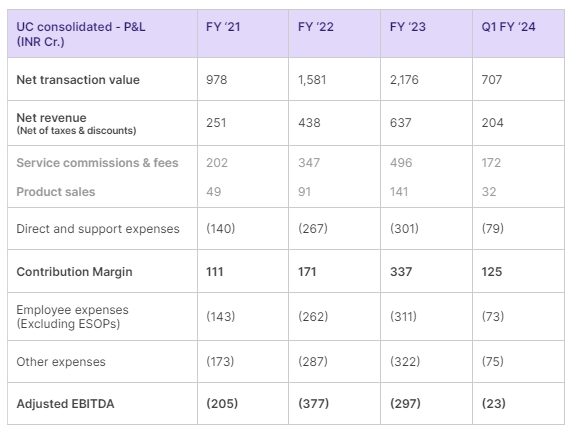

Our growth in FY23 came on the back of investments in service quality, partner training and enablement, new innovations, brand building and technology development. We saw steady business growth with revenue from operations (consolidated) growing by 45%, from INR 438 Cr. in FY22 to INR 637 Cr. in FY23. We also made meaningful progress towards improving profitability driven by operational leverage in fixed costs and driving efficiency across other costs. Losses for the year declined from INR (514 Cr.) in FY22 to INR (308 Cr.) in FY23.

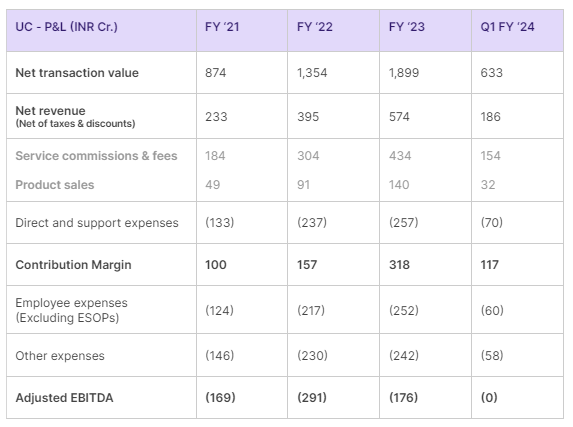

The India business broke even on an adjusted EBITDA basis during Q1 FY24 with negative working capital. Our India business contributes approximately 90% of our revenues. We remain focused on improving profitability for India and UC as a whole. Our strong unit economics with focused cost control will help us drive EBITDA improvement as the business scales.

In the tables below, we have used additional non IND AS financial measures — Net Transaction Value, Contribution Margin and Adjusted EBITDA. We believe these non GAAP financial metrics along with other non financial metrics will help readers better understand business and financial performance. GAAP metrics mentioned under Q1 FY24 are unaudited.

Table 1: Urban Company’s key metrics

Table 2: Urban Company consolidated financials overview

Table 3: The India business broke even at Adjusted EBITDA level in Q1 FY ‘24

Table 4: UC Consolidated P&L Statement

Table 5: UC India P&L Statement

Table 6: Detailed walk between Adjusted EBITDA and Loss Before Tax (Consolidated, IND AS)

Customer excellence

We prioritize customer experience above all else and work backward from the promises we make to our customers. Our approach towards customer experience is one of continuous improvement across five key pillars — Quality, Convenience, Value, Selection and Trust.

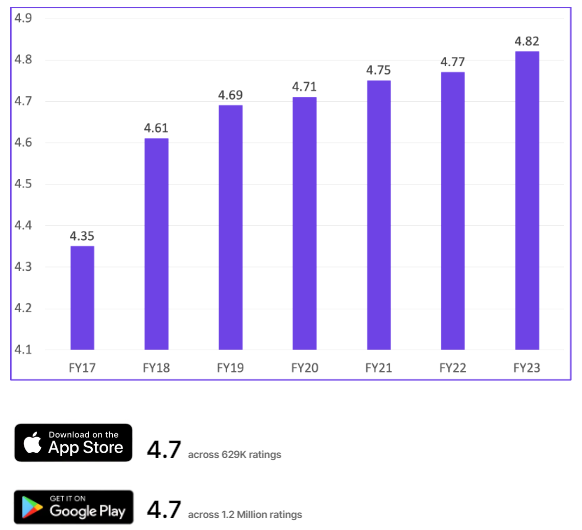

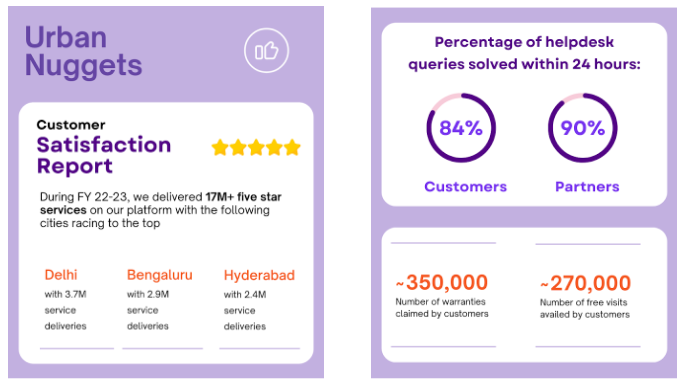

Over the years, we have seen a steady improvement in average ratings given by customers at the end of each service. In FY23, customers on average rated our services at 4.82/5.0, across millions of ratings collected on our apps. These included more than 17 million services rated 5-stars by our customers. On third party platforms such as the Google Playstore and the Apple App Store, our average app rating is 4.7 (on a scale of 5) across > 1.8 million ratings, a reflection of our service quality and the convenience offered by the platform.

Average customer ratings on a scale of 5

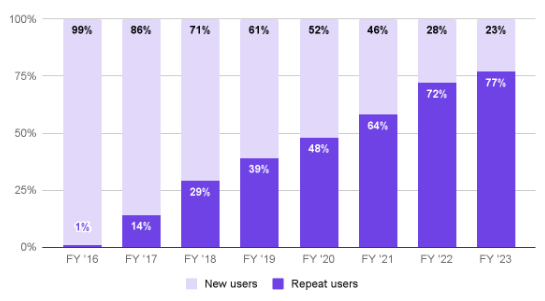

This focus on customer excellence has helped us grow the share of repeat bookings steadily each year. Repeat customers (Acquired in years prior to FY23) contributed ~77% of the Net Transaction Value of the platform during FY23. We expect this number to surpass 90% in the coming years.

Share in new users vs repeat users in NTV

We help partners deliver great experiences by focusing on continuous training programs, both in person and online. Partners are supported to improve their performance through the following efforts:

- Extensive training program for all partners joining the platform, focused on both soft skills and technical skills. Our training programs are typically of two types — Short duration for professionals with prior experience and long duration for freshers.

- Advanced training modules enabling career advancement of partners. These modules emphasize on technical skills for complex service delivery, and developing the partner’s soft skills further.

- Hand holding for the first 30–60 days of being live on the platform by trainers and senior partners

- Constant feedback loop from customers and trainers and subsequent assessment post retraining

- Train the trainer programs and ensuring accountability by coupling the trainer’s performance with the performance of the trainee, i.e. the partner

- Retraining modules aimed at improving specific skills for underperforming partners

- Ongoing training programs during introduction of new service SKUs or products, to further hone the soft skills of our partners or focus on key aspects such as gender sensitivity

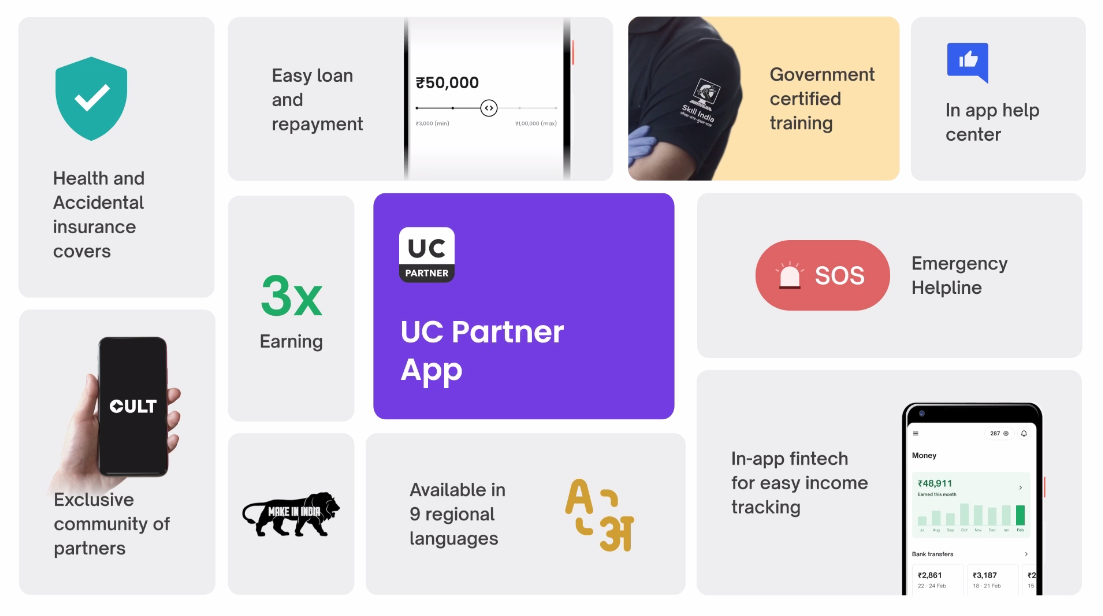

- Continuous e-learning through CULT, a social media feature on our UC Partner App, that allows trainers and partners to have a common ground for knowledge sharing

- Regular workshops on wealth management, investment and maintaining health and well-being

Through the above interventions, we support partners to improve their performance across a few key parameters — Average ratings, order acceptance %, order cancellation % and the usage of genuine products. To further improve customer experience and reduce error rates in delivery, we have recently raised the operating standards for partners on the platform. Our business teams are organizing focussed group discussions with partners explaining the rationale for this change. Our goal is to work with all partners to help them improve and deliver delightful service experiences to consumers.

Partner empowerment

We are determined to make a real difference in the lives of our Service Partners, enabling them to lead decent middle-income livelihoods. This helps our Partners earn significantly more than what they can in offline models and creates a long-term sustainable career path for them.

To this end, we are committed to delivering on our four key pillars of Partner Enablement:

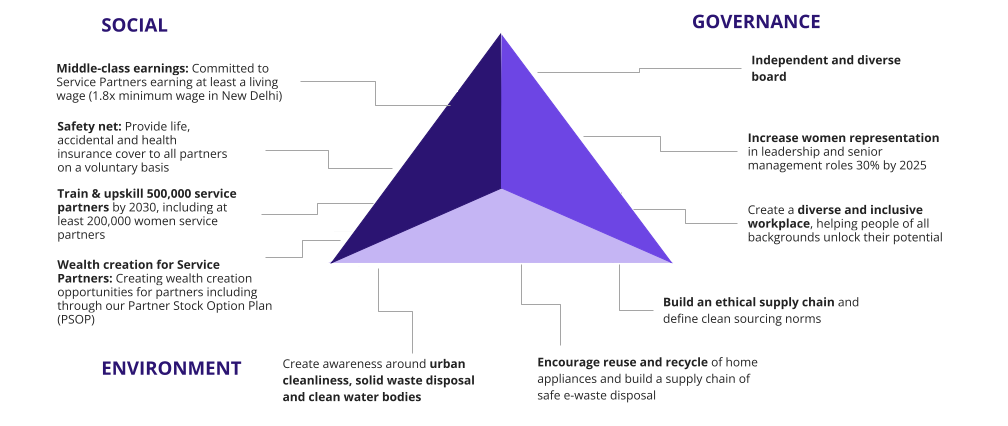

- Living wages: Increased earnings have always been a key pillar of partner enablement at Urban Company and are a major source of upward social mobility for service partners. We are committed to ensuring our service partners earn living wages and not just minimum wages. According to our latest Partner Earnings Index for H1 CY23 (Read here (A)), our service partners continue to benefit from increased earnings:

- The average monthly earnings of all service partners on the platform have increased by more than 10% over H2 CY22

- Top 20% partners earned an average of ~ INR 40,000 per month, net of all commissions and other related costs (Travel, product expenses etc.) in H1 CY23

- Average net earnings of partners delivering >30 services per month (53% of our base in H1 CY23) was ~ INR 32,000

A. UC Partner Earnings Index for H1 CY23 can be accessed here.

2. Social security benefits: All active partners in India benefit hfrom a free life, accidental and health insurance cover. Details of our social security benefits for partners in India are detailed below:

- Free life insurance cover of INR 6 lacs

- Free disability insurance cover of INR 6 lacs

- Free health insurance cover for up to INR 1 lacs

- Select high performing partners get a free family health insurance cover of INR 2 lacs covering their spouse and two kids

- Up to 12 free medical consultations per year

Additionally, we enable access to credit on easy terms for our partners through tie ups with NBFCs and fintechs. All eligible partners can avail personal loans up to INR 1 lacs and initial kit loans at attractive interest rates.

3. Training & upskilling: To ensure consistently good service experiences, we have built a vast network of training centers and industry experts who train and upskill our service partners everyday. We have invested more than INR 250 Cr. since inception in training and upskilling our partners. Our training programs are either completely free or highly subsidized for partners, with ~ 90% of the cost of training being borne by Urban Company.

4. Wealth creation: Creating a win-win environment implies that the growth of our business is synonymous with the growth of our partners. There’s no stronger testament to this value that we hold dear than our industry-first Partner Stock Option Plan (PSOP). Our Service Professionals get to enjoy the fruits of their hard work and partake in the company’s growth. In FY23, we granted stocks to 500 service partners, of whom 30% were women.

ESG and Corporate Governance

Building a world-class institution requires having the right set of folks to guide and advise us and ensure we do right by all the stakeholders involved — our customers, service partners, investors, employees, government and civil society at large.

Our nine-member Board is instrumental in providing input to our management on strategy, growth, profitability, and doing right by all stakeholders while maintaining the highest standards of corporate governance. Their varied skill sets, experience, and background help the organization with strategic guidance, valuable insights, and prudent counsel. The board comprises 3 executive directors (the founders), 3 non executive directors from our investors, and 3 independent directors. Our independent directors also chair the organization’s independent Audit, Risk Management, Nomination and Remuneration, and Corporate Social Responsibility committees.

Brief Profile on Urban Company’s Independent Directors is given below. To know more about our Board and ESG commitments, read our latest ESG report.

- Ms. Ireena Vittal: She was a former partner with McKinsey & Co. for 16 years where she served global companies on issues of growth and sustainable scale up. She is an independent director with companies such as Asian Paints, Godrej Consumer Products, Compass Plc, Diageo Plc etc.

- Mr. Shyamal Mukherjee: He was the former Chairman of PricewaterhouseCoopers (‘PwC’) in India. At PwC, he strengthened the firm’s future readiness by investing in capabilities across its people, go-to-market and internal transformation. He is an independent director with ITC and Airtel.

- Dr. Ashish Gupta: Dr. Ashish Gupta is an entrepreneur, advisor and angel investor. He co-founded Helion Advisors in 2006. Prior to Helion, Dr. Gupta was a Partner with Woodside Fund and had co-founded two companies — Tavant Technologies and Junglee.com, which was later acquired by Amazon. He is an independent director with Info Edge.

Disclaimer: This blog and the information set out herein is for information purposes only and should not be considered investment advice. Nothing in this blog constitutes an offer, solicitation, invitation to offer or advertisement with respect to the purchase or sale of any securities of the Company in any jurisdiction and no part of it shall form the basis of, or be relied upon in connection with, any contract or commitment whatsoever. Potential investors should not rely on the contents of this blog for making any investment decision in the Company.

[ad_2]

Source link