Stock screeners are essential in this effort—once you’ve screened for stocks with a history of dependable dividend payments, review their history to determine if the payments have steadily increased. Reliable hikes to dividend payments indicates a company’s commitment to returning profits to shareholders. Advisors say one of the quickest what is a dividend account ways to measure a dividend’s safety is to check its payout ratio, or the portion of its net income that goes toward dividend payments. If a company pays out 100% or more of its income, the dividend could be in trouble. Like a stock’s dividend yield, the company’s payout ratio will be listed on financial or online broker websites.

- NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

- You are now leaving the SoFi website and entering a third-party website.

- If an investor receives stock dividends, though, that’s typically not taxable until the investor sells the holdings later on.

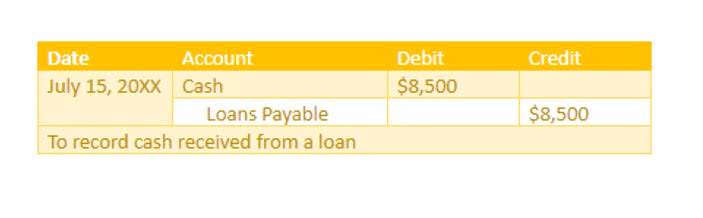

- Similarly, the company must also create a liability for the amount of the declared dividend.

- Companies can choose to regularly reward their shareholders by paying dividends, usually in cash, although sometimes in stock.

Dividends: Definition in Stocks and How Payments Work

If you are interested in investing for dividends, you will want to specifically choose dividend stocks. Companies that increase their dividend payments year after year are usually less volatile than the broader market. And the steady income from dividends can help smooth out a stock’s total return. Companies that adopt a residual dividend policy pay their shareholders a dividend from their remaining profits after paying for capital expenditures and working capital requirements. As with constant dividend policy, the residual dividend policy can create volatile returns for shareholders depending on the profits, capital expenditure, and working capital requirements of a company.

Stock Strategies

This type of dividends increases the number of shares outstanding by giving new shares to shareholders. Instead of reducing cash, stock dividends increase the number of shares. One of Warren Buffett’s favorite stocks to buy since the start of 2022, integrated oil and gas stock Occidental Petroleum (OXY -0.12%), is Berkshire’s second-most-important dividend stock. The roughly 255.3 million shares of common stock owned will generate in the neighborhood of $224.6 million in annual dividend income. Meanwhile, $8.489 billion in Occidental preferred stock yielding 8% should provide another $679.1 million.

ways I could earn lifelong passive income from UK shares

Be cautious of excessively high yields, as they may indicate potential risks or issues with the company. Also, keep an eye on the payout ratio; anything above 60% is cause for concern. Dividend stocks can provide you with a source of income that can help you reach your financial goals.

- Let us say the stock price drops from $32 to $27; if that happens, the yield will jump to 6.4%.

- It has the adverse effect of diluting earnings per share, at least temporarily.

- Income from dividends also cushions the blow if a stock’s price drops.

- Diversification should always be top of mind for any investor, and someone who focuses too much on dividends is likely to ignore some sectors and classes of companies they need for good diversification.

- They believe they can create a better return for shareholders by reinvesting all their profits in their continued growth.

A dividend investing strategy is one way many investors look to make money from stocks and build wealth. Dividend yield1 is the annual return an investor receives in the form of dividend payments, expressed as a percentage of the stock’s share price. It’s an easy way to compare the dividend amounts paid by different stocks. It’s calculated by dividing the annual dividend per share by the price per share, then converting the result to a percentage.

- You will not receive a dividend payment if you buy a stock after the ex-dividend date.

- Money market funds and other cash-like instruments also pay ordinary dividends.

- Dividends are often paid quarterly, but could be paid at other times.

- Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website.

- The focus here would be on slow-growing, established companies with a lot of cash flow that pay high dividends.

- By comparison, high-growth companies, such as tech or biotech companies, rarely pay dividends because they need to reinvest profits into expanding that growth.

- A dividend is a payment in cash or stock that public companies distribute to their shareholders.

What is your current financial priority?

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues.

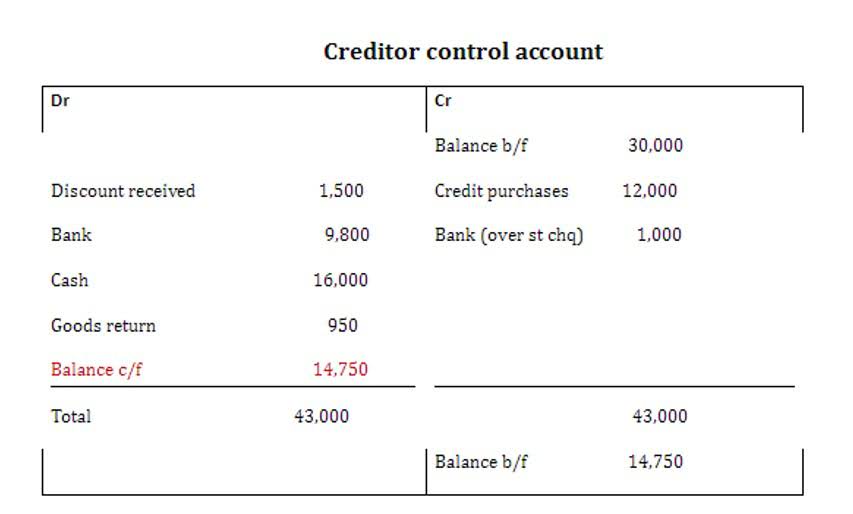

Free Accounting Courses

However, it’s not a good look for a company to abruptly stop paying dividends or pay less in dividends than in the past. Preferred stock is a type of stock that functions less like a stock and more like a bond. Dividends are usually paid quarterly, but unlike dividends on common stock, dividends on preferred stock are generally fixed. If a company’s board of directors decides to issue an annual 5% dividend per share, and the company’s shares are worth $100, the dividend is $5. If the dividends are issued every quarter, each distribution is $1.25.

- These calculations depend on several factors such as the dividend policy of a company, its past dividend payouts, its dividend payout ratio, etc.

- Most businesses were hurt by the pandemic, but when people were forced to isolate, it helped boost interest in the company’s easy-to-prepare meals and snacks.

- Some of the names that made the list include medical image machine maker Roper Technologies, paint maker Sherwin Williams, and alcohol distributor Brown-Forman.

- Dividend reinvestment plans (DRIPs) are commonly offered by individual companies and mutual funds.

- Companies pay out their dividends in different ways depending on their business model or board of directors’ decision.

More on Investing Articles